carried interest tax reform

The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for services provided. Back to Tax Reform.

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White.

. There are various uncertainties regarding the application of the rules for carried interest introduced under US tax reform in 2017. Carried interest has long been the target of lawmaker scrutiny. The multifamily industry believes a one-year holding.

Current tax law treats carried interest as a long-term capital gain if the underlying asset is held for at least three years. The Carried Interest Rate Should Be Kept or Cut Seton Motley. Hiking taxes on carried interest capital gains is one such proposal.

Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka. Recently Congress passed 2017 Tax Reform and included a new provision meant to address the criticism that carried interests provide favorable tax treatment deferred gains. The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to.

Since then at least. Carried interest allows hedge funds to evade their tax obligations. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax.

Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation. Some view this tax preference as an unfair market-distorting loophole.

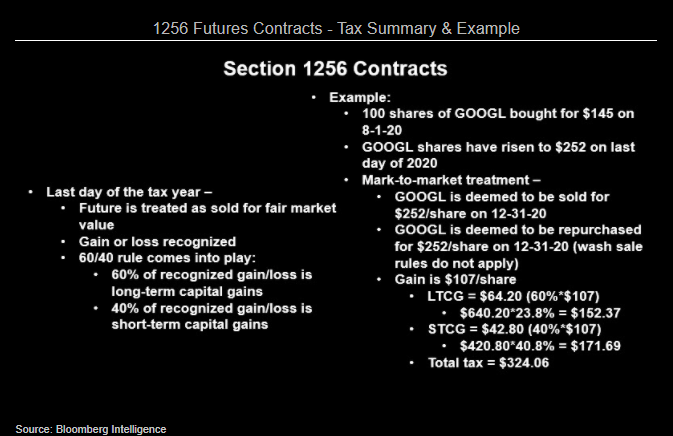

Section 1061 which was added to the Code as part of the 2017 Tax Cuts and Jobs Act provides that capital gains allocated to a carried interest holder will only be treated as. Tax reform introduced new rules seeking to. Enacted as part of the 2017 Tax Cuts and Jobs Act Section 1061 was the first step taken to curtail the preferential treatment of carried interests.

While the Stop Wall Street Looting Act a comprehensive bill first introduced in 2019 never. About to end is the August recess Congress so richly earned with their great first-half-of-the-year work repealing Obamacare and other long-promised Republican-control-of-Washington-contingent agenda. Washington DC Rep.

This new code section is targeted toward managers in the private equity and hedge fund industry who in exchange for services often receive a percentage of a funds future. Big Taxes - Deserve Big Cuts. In 2014 Ways and Means Committee Chairman Dave Camp introduced a tax reform bill that would have raised rates on carried interest to 35 percent.

The key change established. Senators Sherrod Brown D-OH Tammy Baldwin D-WI and Joe Manchin D-WV introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. November 1 2021.

Though there is a lot of inflammatory political rhetoric directed at the tax treatment of carried interest theres a limited. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried. Sander Levin today reintroduced legislation to tax carried interest compensation at the same ordinary income tax rates paid by other Americans.

This same loophole also fuels other predatory investing strategies that originate with private equity and. Republican lawmakers carried interest reform doesnt require proceeds from profits interests to be treated as ordinary income which would be real reform. Others argue that it is consistent with the tax treatment of other entrepreneurial income.

A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it would not share.

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Carried Interest Regulations And The Future Of A Debated Tax Break 2021 Articles Resources Cla Cliftonlarsonallen

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Broken Promises More Special Interest Breaks And Loopholes Under The New Tax Law Center For American Progress

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Deductibility What Is The Best Option For Your Family Office Structure Goulston Storrs Pc Jdsupra

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

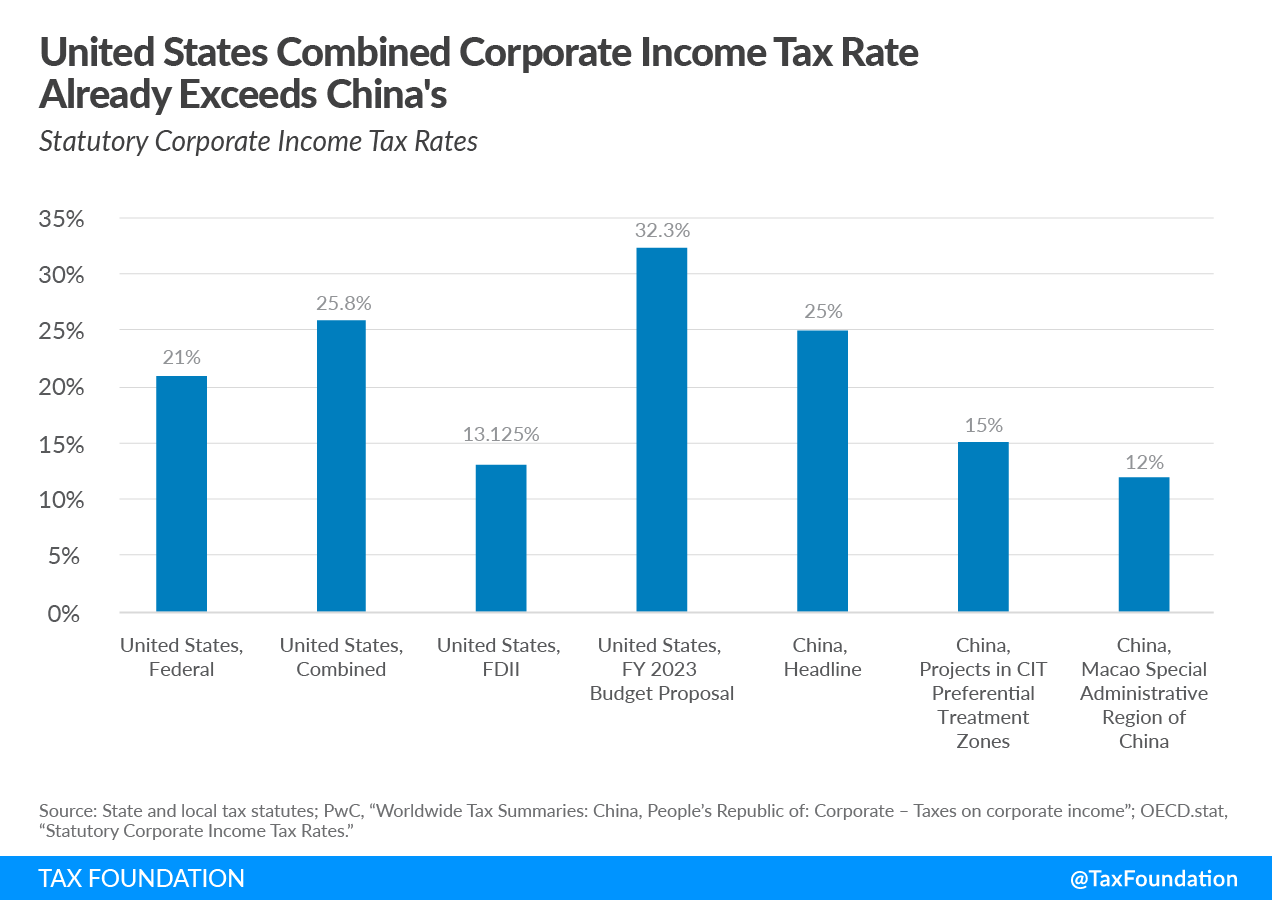

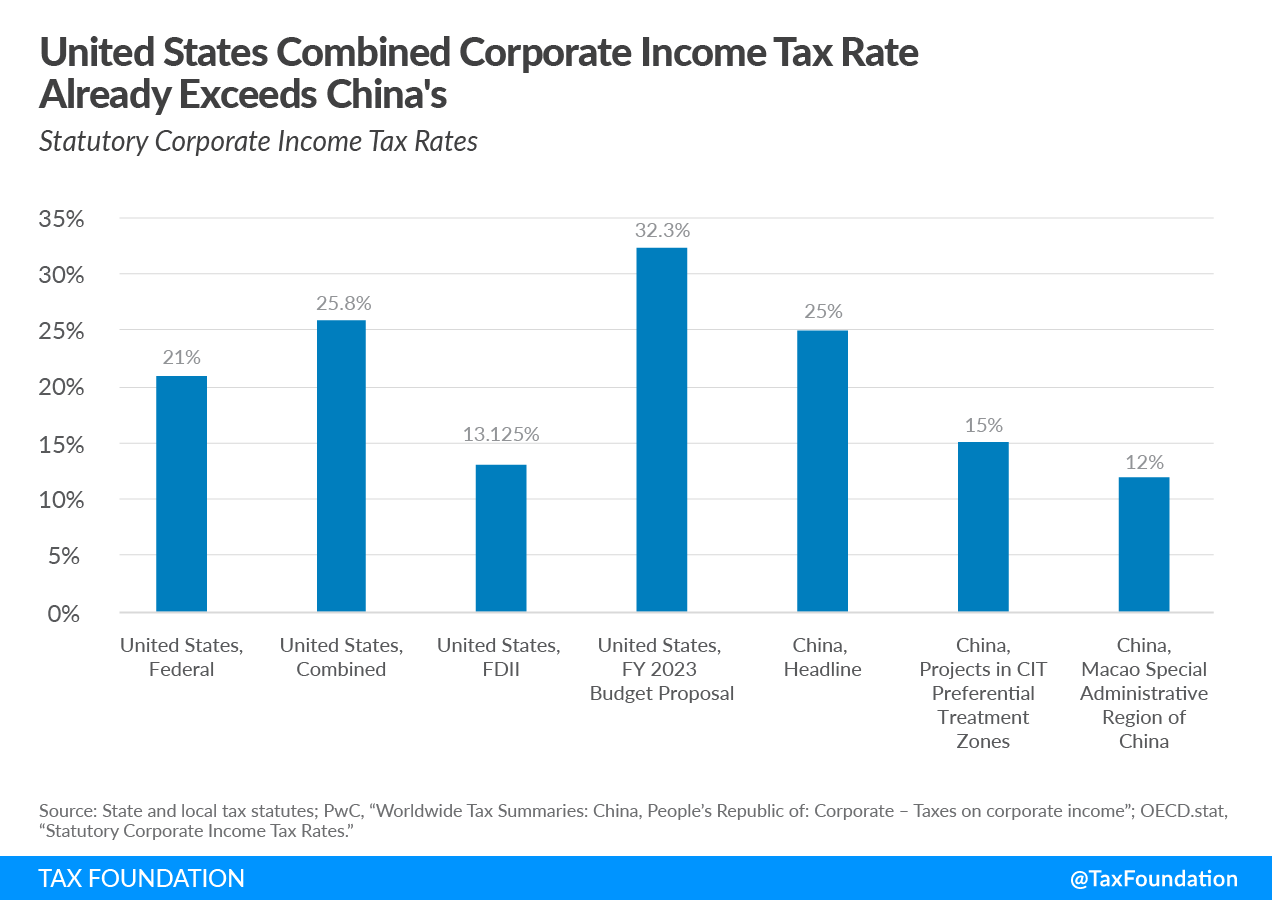

Us China Competition Usica Competes Act Corporate Tax Comparison

Capital Gains Full Report Tax Policy Center

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

What Are The Consequences Of The New Us International Tax System Tax Policy Center

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)